All those numbers that are on the front of your credit card can be confusing. But the numbers on your credit card can be easily understood when broken down individually. Every one of those numbers identifies who provided the card, which bank, account information, and even some for security checks.

What do the numbers on my credit card mean?

What do the numbers on my credit card mean?

The only company that assigns numbers to certain networks is the nonprofit American National Standards Institute ANSI. They provide the numbers for cards such as Visa or MasterCard, and financial institutions, like (BOA) Bank of America or Chase Bank.

What happens when I swipe my credit card?

When you swipe your credit card… the magnetic strip on the back uses the CC terminal to route the transaction. It sends it to the proper credit card network. It then goes into the financial institution or bank that is shown on your credit card. The card is then authorized and the transaction completes.

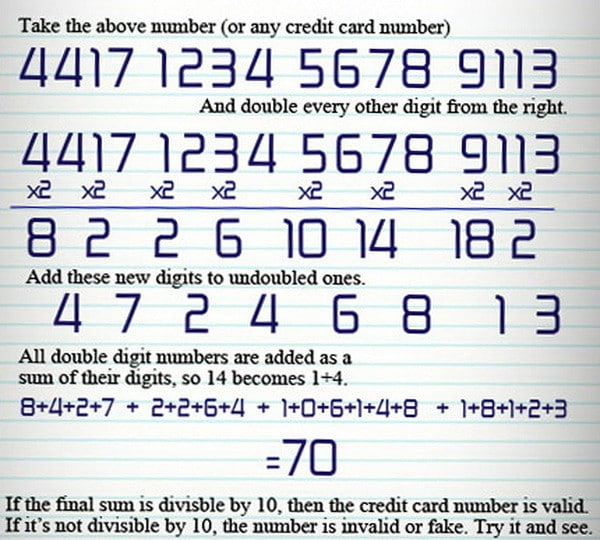

All credit cards need to agree with the Luhn Algorithm System. The Luhn System will determine if the card is valid. This system is a complex mathematical algorithm. These large number combinations need to add up to a number always ending in a 0. If the number adds up to a multiple of 10, it is valid, if not, it is invalid.

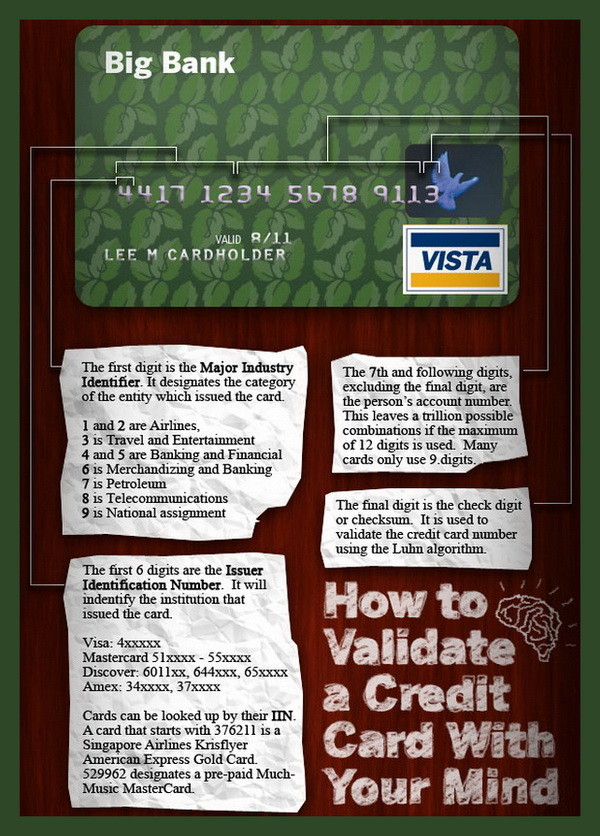

Usually the first number (and sometimes second number) of a credit card identifies the provider. The next numbers determine everything like the currency being used, the bank, and the persons account number.

Numbers of a credit card decoded

Numbers of a credit card decoded

To be more detailed about what each credit card number represents:

GENERALLY… The first digit indicates what type of card: The number 4 is Visa and the number 5 is MasterCard. The first 7 numbers tell the bank institution data. The last 9 numbers tell personal account data. It may not be your exact credit card account number but it does contain the info to point your institution to the right place.

Visa Card Numbers Identified:

The first digit assigned to all Visa cards is a 4. The 2 to 6th numbers are the financial institution the card is connected to. The 7th to 12th digits (or the 7th through 15th) are the personal account number. The final 13th or 16th number is a check number.

MasterCard Numbers Identified:

MasterCard uses the number 5 as the first number on every card. (The full number on the card will always be 16 digits) The 2nd and 3rd, 2nd and 4th or 2nd and 5th represent bank number. Every number up through 15 is the account number. The final number 16 is the check digit number.

American Express Card Numbers Identified:

American Express uses the first two numbers of the card for identify. The two digit number will be either 34 or 37. The third and fourth digit tell the type of card and what the currency is. The next six numbers, 5 to 11 is the number of the personal account. The 12th, 13th, and 14th digits represent the card number account. The last number on an American Express card is a check digit. This is a random number used to protect against any errors and all fraud type.

More about other credit cards:

Discover cards always start with the number 6 and are 16 digits long. Gas credit cards start with the number 7 and airline credit cards start with the number 1.

ANSI Standard X4.13-1983 is the system used by most national credit-card systems.

The first digit on your credit card number identifies the card company:

A credit card beginning with the number 3 = Entertainment and Travel cards like American Express or Diners Club

A credit card beginning with the number 4 = Visa

A credit card beginning with the number 5 = MasterCard

A credit card beginning with the number 6 = Discover Card

A credit card beginning with the number 34 or 37 = American Express (AE)

A credit card beginning with the number 38 = Carte Blanche and Diners Club

Do you know of other credit cards that use a different numbering system? Please let us know by leaving a comment below.

Leave a Reply